Introducing

Ceyron is here to offer you one of the only private security tokens representing an equity portion of Ceyron with the intent to offer security, transparency and dividends. Ceyron.io will be a cryptocurrency-based investment platform with a cryptocurrency trading terminal, debit card capabilities, and offering tokens backed by secured credit assets. CEY Tokens will enable industry leading foreign exchange rates and asset management with a portfolio of secured creditassets, insured, and robust returns translating into increased stability for investors.

Token is something that can be used instead of money. CEY Tokens are digital tokens that will be issued to the investor(s) and represent beneficial ownership interests in a separate class of non-voting equity shares in Ceyron. CEY Tokens are functional utility smart contracts within the Fund. CEY Tokens are non-refundable. That are not for speculative investment.

Ceyron Finance Sarl (CFS), is a Limited Liability Company incorporated under the Limited Liability Companies Law, (the “Fund”), and is wholly owned by Ceyron Finance Ltd. CFL and the Fund have entered into an Operating Agreement setting out the rights and obligations of each party.

The Fund will be managed and advised by Colombus Investment Management Ltd, (the “Fund Manager”). Colombus Investment Management Ltd, is a British Virgin Islands registered as an independent alternative investment management company specializing in alternative assets and global asset allocation. The Fund Manager will be responsible for the Fund’s operations and will perform all services and activities relating to the management of the Fund’s assets, liabilities, and operations.

Investment Objective and Strategy

The Fund’s investment objective is to provide attractive returns on invested capital through a proprietary quantitative approach to underwriting credit assets, to be provided by Colombus Investment Management Ltd. The Fund will adhere to an investment strategy driven by data science, in which machine learning within fully non-parametric statistical models are applied to the problem of expected gains in financial investments.

The net income earned by the Fund during any given month shall generally be retained for reinvestment, but a portion of potential periodic earnings may be used for distributing annually dividends to CEY Token holders, where such dividends are approved by CFL’s board and voting shareholders.

Credit Portfolio Backed Token To Provide Less Volatility and More Cash Flow

The portfolio of credit assets will further be secured by a surety wrap to enhance stability and returns. The Fund Manager will use artificial intelligence and machine learning to build a portfolio of secured credit assets.

Blockchain Technology Enables Efficient Liquidity for Investors

Blockchain technology has the potential to provide greater integrity, safety, security, and transparency. As such, CFL will use the blockchain to ensure immediate transaction adjudication at low costs in hopes of providing greater liquidity for investors.

Efficient Prepaid Debit Cards

The account holders will be empowered to select from multiple cryptocurrencies for use as tender, and when they initiate a transaction (e.g. a dinner that costs $83.65), either prepaid debit cash will be used, or the holder can elect to use a supported cryptocurrency, which will then be sold at spot price to complete the transaction.

Competitive Fees

Since CFL will hold both cash and an array of cryptocurrencies at all times, it will be able to facilitate seamless exchange of cash in cryptocurrency to facilitate transactions, and will enable CFL to compete with Coinbase on both service and fees.

CFL is Launching into a Growing Market

The market for cryptocurrencies has grown by more than one hundred and sixty billion USD ($160,000,000,000) in the last year. Financial giants and Central Banks alike have invested in blockchain technology. Both large and small investors seek a more regulated market that allows for the safety nets and insurance coverage offered in any registered security market.

Problem Statement For The Developing World

The population of the Developing World (South East Asia, Latin America, and Africa) accounts for over 2 billion people. Africa alone represents 1.2 billion people. It is young and dynamic: 60% are under 50 years.

Banks are progressively adopting mobile banking to:

1) develop online banking services;

2) take digital advantages to parties to integrate millions of people into the formal financial sector;

3) develop merchant payment services.

Low banking rate

According to experts, more than 2.5 billion people with low- income and/or middle-income are not linked to a bank. The traditional agency model easily meets the needs of the poorest but not longer fully meets the requirements of banks.

The reasons for the low banking penetration are at two levels.

- At the client level: most people have only low or very low income, and thus low savings capacity. While monetization of the economy has increased significantly since the 2000s, the use of a bank is not yet part of the spontaneous practices. The emergence and rapid growth of very strong micro finance companies are radically changing this situation.

- At the bank level: the relative excess liquidity of banks is not an incentive to the development of customers. The weak population density adds the average costs of implementing agencies.

Over 75% of countries have the majority of services where mobile money services were already available. This increased competition means consumers have more options. Some subscribe to two or three services simultaneously.

Very low use rates

Africa is the world leader in the field of mobile money accounts 2% of adults hold a mobile money account in the world, 12% of holders are in Africa. Each year the number of open mobile money accounts increased by over 40% on average. By 2020, the number of Africans with discretionary income - nearly 450 million people - will be comparable, if not superior to that of Western Europe with an average growth rate of 20% annually. In 2020, there will be nearly 800 million people who have a mobile money account. Resulting in the potential of almost 10 billion transactions per day valued at nearly $135 billion dollars in 2020.

The analysis of user behaviour means of payment appears to be a general trend: the withdrawal represents at least 60% of transaction volume; peer- to- peer transfer operations 20%; purchasing call time 10%;payments 8% and savings 2%.

CEY token holders will have the privilege to receive their annually dividend on their CFL card.

Lack of secure and non secure credit for credit applicants

CFL has the intention to resolve the issue in Africa where there is a lack of credit available for most applicants.More specifically, the dividends distributed to CEY token holders will enable them to be eligible for credit because the dividends could be considered as one source of income.

In Africa, there is a lack of steady and sustainable income when it comes to credit applications.

CFL’S Solution

CFL Credit Portfolio

Today, sixty percent (60%) of U.S. mortgage credits are held by non-banks, up from thirty percent (30%) in 2013. Over four trillion USD ($4T) in U.S. mortgages alone are available to select from hundreds of non-bank credit platforms. The Fund Manager is tasked with approving the solvency and risk associated with the platforms themselves and identifying the credit profiles of originated assets, from regulatory compliance on originations, volumes, collateral, duration, and rate, to quality of management and servicing. The Fund Manager will be tasked with selecting the highest performing assets available within these platforms for the CFL portfolio, as well as purging the highest risk assets from the CFL portfolio.

Investment Roadmap

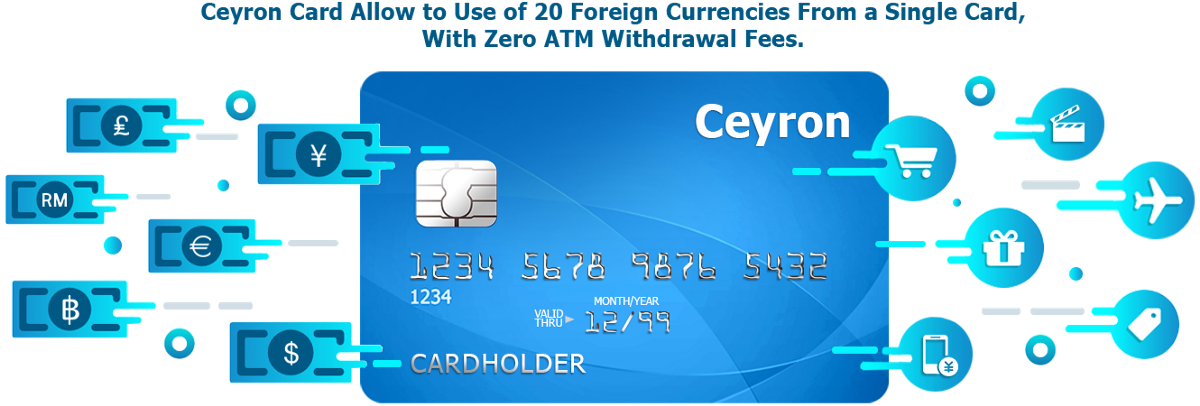

The CEY Card will be a physical, virtual, and debit MasterCard with mobile application which will allow for the use of twenty (20) foreign currencies from a single card. CFL may save customers up to seventy percent (70%) on these fees. Currencies can be exchanged both at the point of sale (industry average is 3.75% versus 3% fee for CFL), and also through an app. Additionally, unlike the standard one and a half percent (1.5%) fee for ATM withdrawals, CFL will assess no fee for ATM withdrawals. The CFL mobile application will contain additional functionality to transfer funds in any currency between merchants, as well as friends and family accounts, resulting in a zero percent (0%) money transfer fee.

The CFL Card plans to have a Partner for expense management. This will allow integration from a mobile application to facilitate management of travel itineraries and links to many travel partners for e-receipt management. In summation, the CFL card will be developed to provide increased liquidity in any of the twenty (20) global currencies as well as leading crypto currencies.

CFL and the Blockchain

A cryptocurrency (or crypto currency) is a digital asset designed to work as a medium of exchange that uses cryptography to secure its transactions, to control the creation of additional units, and to verify the transfer of assets.

Cryptocurrency was designed as a method for decentralized transactions with value held in scarce digital goods. It appeals most strongly in societies where governments have made their currency worthless through hyper-inflation. Today, fifty percent (50%) of people globally have bank accounts. In 2014, it was sixty-two percent (62%), and cryptocurrencies are taking greater footholds among the unbanked.

The market for fiat currency to cryptocurrency has only been operational for a few years. Illustrative of the current level of maturity of the industry are the relatively large differences between prices in fiat currency of Bitcoin on the various major exchanges.

Blockchain technology is still young, but it has already proved its capability as an immutable ledger. Bitcoin is a purely speculative token, and its value, much like diamonds or gold, outside of industrial uses, is entirely driven by scarcity and the guarantee for the holder that this good is unique and ready for transaction

CFL Security Token

- CFL intends to provide, but does not guarantee, the token holders with a annually dividend, which must be approved by the Board of Directors and holders of voting shares.

- CFL intends to invest eighty-five percent (85%) of the proceeds received by CFL from this Offering in the Fund, and the Fund in turn will invest in credit assets, thereby seeking to create a stable, growing cash flow yielding base for the CEY Token (Cash flow yields cannot be guaranteed, and may be impacted by both market and regulatory conditions)

- CFL intends to use modest leverage to further enhance the returns from its credit portfolio to facilitate ongoing and continued reinvestment to grow the credit portfolio underpinning the CEY Tokens (Enhanced returns cannot be guaranteed, and may be impacted by both market and regulatory conditions)

- CFL will enhance its ability to establish its credit portfolio with leverage by providing its warehouse lender a credit surety bond.

- CFL intends to maintain a cash, securities, and token reserve at all times to ensure liquidity for CEY Token holders (Liquidity of assets cannot be guaranteed, and may be impacted by both market and regulatory conditions).

- CFL will enter into alliances with surety wrap providers that will be used to mitigate risk of total capital loss. However, use of these financial instruments does not constitute a guarantee against any and all eventualities.

CFL’s strategic alliances are established leaders in the field of blockchain technology, finance, and banking. CFL intends to enter into a service agreement with Coinfirm.io regarding KYC/AML (Anti Money Laundering) checks for each token holder application. Ambisafe is a blockchain technology pioneer and ICO offering company helping the world become more decentralized since 2010Their work has been critical on projects such as Tether and Bitfinex. More recently Ambisafe is behind such ICO successes as. Loyal Bank is a bank registered under the laws of Saint Vincent & The Grenadines.

Market Plan

CFL’S Initial Coin Offering

The offer of CEY Tokens in Saint Vincent & The Grenadines is being made in reliance on the exemption under the Securities Act. The CEY Tokens offered herein (and the corresponding non-voting shares in CFL Ltd. held by the Nominee) shall not be subsequently sold to any person pursuant to another offer in Saint Vincent & The Grenadines unless the provisions of the FSA are complied with.

CFL will be providing an Offering Memorandum that will be prepared solely for use by prospective investors in CFL, to be issued by CFL. The Offering Memorandum will be prepared in connection with a private offering to accredited investors, individuals who will be required to verify their accredited investor status through a questionnaire and other necessary documentation, and other individuals globally who meet the requirements for participation in the jurisdiction in which they reside.

Summary of the Offering

Technical Offering Mechanism

Potential investors will be asked for personally identifiable information upon creating an account on ceyron.io to participate in the sale. This information is to ensure compliance with the various securities laws of the United States and foreign jurisdictions, as well as the Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements.

For United States investors, they must satisfy the obligations promulgated under the “accredited investor” standard pursuant to Regulation D, Section 506(c) of the Securities Act. An investor can demonstrate that they qualify as an accredited investor by substantiating and uploading documents on ceyron.io as outlined in the following section “Participation in the Offering.”

Participation in the Offering

This Offering for prospective United States investors is limited solely to accredited investors as defined in Regulation D under the Securities Act, meaning only those persons or entities coming within any one or more of the following categories:

- Any bank, as defined in Section 3(a)(2) of the Securities Act, or any savings and loan association or other institution defined in Section 3(a)(5)(A) of the Securities Act, whether acting in its individual or fiduciary capacity; any broker-dealer registered pursuant to Section 15 of the Exchange Act; any insurance company, as defined in Section 2(13) of the Securities Act; any investment company registered under the Investment Company Act of 1940 or a business development company, as defined in Section 2(a)(48) of that Act; any Small Business Investment Company licensed by the United States Small Business Administration under Section 301(c) or (d) of the Small Business Investment Act of 1958; any plan established and maintained by a state, its political subdivisions or any agency or instrumentality of a state or its political subdivisions for the benefit of its employees, if such plan has total assets in excess of five million USD ($5,000,000); and any employee benefit plan within the meaning of the Employee Retirement Income Security Act of 1974, if the investment decision is made by a plan fiduciary, as defined in Section 3(21) of such Act, that is either a bank, savings and loan association, insurance company or registered investment advisor, if the employee benefit plan has total assets in excess of five million USD ($5,000,000) or, if a self-directed plan, with investment decisions made solely by person(s) that are accredited investor(s);

- Any private business development company as defined in Section 202(a)(22) of the Investment Advisors Act of 1940;

- Any organization described in Section 501(c)(3) of the Internal Revenue Code of 1986, as amended, any corporation, Massachusetts or similar business trust, or company, not formed for the specific purpose of acquiring the Common Stock, with total assets in excess of five million USD ($5,000,000);

- Any director or executive officer of the Company;

- Any natural person whose individual net worth, or joint net worth with that person’s spouse, exclusive of the value of the person’s primary residence net of any mortgage debt and other liens, at the time of his or her purchase exceeds one million USD ($1,000,000);

- Any natural person who had an individual income in excess of two hundred thousand USD ($200,000), or joint income with that person’s spouse in excess of three hundred thousand USD ($300,000), in each of the two most recent years and who reasonably expects to reach the same income level in the current year;

- Any trust with total assets in excess of five million USD ($5,000,000), not formed for the specific purpose of acquiring the Common Stock, whose purchase is directed by a sophisticated person as described in Rule 506(b)(2)(ii) of Regulation D; or

- Any entity all of whose equity owners are accredited investors

- Accreditation based on Investor’s Income

- Accreditation based on Investor’s Net Assets

- Third-Party Verification Letter

The CEY Tokens are being offered and issued to persons other than U.S. Persons in reliance upon Regulation S under the Securities Act. Each Subscriber of CEY Tokens will be deemed to represent, warrant, and agree as follows:

- Either it is: an “accredited investor” (as defined in Rule 501 of Regulation D under the Securities Act); or not a “U.S. Person” and is acquiring the CEY Tokens in an “offshore transaction”

- If the Subscriber is an acquirer in a transaction occurring inside the United States, you acknowledge that until the Lock-Up Period lapses, you will not be permitted to offer, sell, or transfer the CEY Tokens and that after such date you will not be permitted to sell or otherwise transfer the CEY Tokens to any other U.S. Person unless they sell all of their CEY Tokens to a single U.S. Person.

- If the Subscriber is an acquirer in a transaction that occurs outside the United States within the meaning of Regulation S, you acknowledge that you may not sell or otherwise transfer the CEY Tokens at any time to a U.S. Person or for the account or benefit of a U.S. Person within the meaning of Rule 902 under the Securities Act. However, a Non-U.S. Persons can sell the CEY Tokens to other foreign investors in an Offshore Transaction in compliance with Rule 903 and 904 under the Securities Act and subject to compliance with applicable laws in other jurisdictions.

- The CEY Tokens shall not be subsequently sold to any person pursuant to another offer in Saint Vincent & The Grenadines unless the provisions of the FSA are complied with.

- Subscriber acknowledges that CFL will not be required to accept for registration of transfer any CEY Tokens acquired by it, except upon presentation of evidence satisfactory to CFL that the restrictions set forth herein have been complied with.

Fund NAV Reporting

CFL intends to publically report the Net Asset Value (NAV) of the Fund on a monthly and quarterly basis on the CFL website.

NAV Calculation Methodology

NAV = (net interest accrued - net loss accrued)/(total principal outstanding + total cash)

The NAV per CEY Token will be calculated by dividing NAV by the number of outstanding CEY Tokens at the calculation date rounded to the nearest cent. The number of outstanding CEY Tokens is calculated as the total number of CEY Tokens issued and outstanding, less any redeemed by CFL.

Ceyron Token

Use of Proceeds

The CEY Token funds will be used to provide funding for the following:

RISK FACTORS

General Business Risks

In the event of an economic downturn, the company’s business plan, ability to generate revenue, and overall solvency may be at risk. Early stage companies in general are highly risky, and the likelihood of failure of the business regardless of the overall business climate is possible.

Specific Business Risks

Investments in vehicles of this nature have various inherent risks, which could result in: (i) complete loss of investors capital, (ii) less than targeted investment results, or (iii) less than expected liquidity, amongst other things.

Credit Risk

There can be no assurance that the investment objective of the Fund will be achieved and that investors will not incur losses. To mitigate the risk of substantial credit losses, CFL will take appropriate credit loss reserves, which will be accrued on each asset according to our credit policy guidelines, which are consistent with typical financial institutions investing in similar credit assets.

Portfolio Risks

There exists the risk that CFL may not achieve its targeted results. The coupon and yield to maturity of the CFL portfolio is critical to our ability to drive consistent dividends to token holders and continue to be able to reinvest in our portfolio, thereby increasing the sustained value of the portfolio and token.

CFL may not be able to achieve its desired levels of leverage on its portfolio at the desired cost of debt. Accordingly, there exists risk that the net portfolio yield to investors may not be achieved. In that CFL intends to utilize senior secured leverage, the risk to the investor may be enhanced by the existence of a senior secured priority lien on the portfolio assets.

Token Liquidity Risk

The CEY Token may not achieve the levels of liquidity desired, resulting in less than expected liquidity for investors.

Regulatory Risk

The failure by CFL to obtain prior regulatory authorization in a jurisdiction where it has operated or the refusal of a regulator to grant that authorization in a jurisdiction where it may wish to operate could prevent CFL from maintaining or expanding its business. Further, changes to laws or regulations, including the enactment of new requirements in relation to regulatory authorization, advertising, the internet, or online commerce (or change in the application or interpretation of existing regulations or laws by regulators or other authorities), in any jurisdiction in which CFL currently carries on business, might oblige CFL to cease conducting business, or modify the manner in which it conducts business in that jurisdiction. Such changes could also have a material adverse effect on CFL’s business, financial condition, and operating results and/or subject CFL or its Directors or customers to additional taxation or civil, criminal, regulatory, or other action.

Data Privacy And Security

All the data provided to us is stored in a secure computing environment protected by secure firewalls to prevent unauthorized access. The company controls access so that only people who need to access the investor data are granted access. All team members of CFL are provided security training and are required to adhere to a comprehensive set of security policies, procedures, and standards related to their jobs.

OUR TEAM

For more Informations:

Author: bakso.super

ETH: 0x0A39Baaa338F9F1f5f5b4e52f82095d0dD7c94D8

AntwortenLöschenDapatkan Double Bonus dari Donaco Poker Setiap Weekend!

Mau Tau Caranya??? Ayo Daftar..!!.atau Hubungi Kami Segera......

Info hub

WHATSAPP : +6281333555662

ERC20 Token Development Services | | STO Development Company | Stablecoin Development Company | NFT Token Development Company | Ethereum Token Development Company |

AntwortenLöschenToken Development Company

AntwortenLöschenToken Development Services

BEP20 Token Development Company

ERC20 Token Development Company

Solana Token Development Company

NFT Token Development Company

Polygon Token Development Company

Smart Contract Development Company

Very useful Blog Content. Keep it up.

AntwortenLöschenBEP20 Token Development Services Company

DeFi Token Development Services Company

Polygon Token Development Services Company

Solana Token Development Services Company

NFT Marketplace Development Services Company

Smart Contract Development Services Company

ICO Development Services Company

"Refi is a carbon credit platform that aims to incentivize sustainable practices by allowing businesses and individuals to purchase and trade carbon credits, promoting a more environmentally conscious economy.

AntwortenLöschenCarbon Credit Platform Development company"

Thanks for sharing P2P cryptocurrency exchange software

AntwortenLöschenBinanceClone Script

AntwortenLöschenWow, I want to salute you. Is a very good comment & very informative as well.

AntwortenLöschenBC.Game Script

SandBox