What's Debitum Network?

Our product is intends to decentralize the financing process. Currently, all steps of the financing process are carried out by one financial institution in a centralized manner from the very beginning to the very end. As a result, such financier can only operate in the local market due to the lack of infrastructure abroad (otherwise it becomes very expensive). Moreover, the capacity of financing is also limited, resulting in only a fraction of SMEs’ needs being fulfilled. Debitum Network will be an ecosystem where participants from all around the world will perform separate steps of the financing process. For example, a German SME needs funding, so it joins to Debitum Network; a risk assessor from Germany rates the risk; credit insurance company from France performs the insurance; a fund from the UK provides the money; a local debt collector from Germany either collects or buys the debt.Relations between business borrowers and lenders are complex, but they can be standardized and streamlined. We build Ethereum-based decentralized ecosystem where operators of the financing market can access their clients in a more advanced way and lower costs. Operators are companies (or even individuals) who either aggregate the demand (investors/lenders) or supply (borrowers), or both. There are service providers like risk assessors, insurers, debt collectors, provision/collateral valuators, etc. Debitum Network will also act like a integration medium for various technical solutions which are related to financing process.

While technically, in terms of economical effectiveness, Debitum facilitates the process of financing, it is an opportunity for professional operators in the financing industry to enter the global market with no barriers. For example, local risk assessors working in their domestic market would be able to sell their services for global investors willing to invest in their market.

Debitum aims to create a self-growing network based on trust by uniting fragmented regional registers of business borrower trustworthiness on the blockchain basis.

Debitum purpose is to provide an access to the lucrative SME capital market for everyone. Today, investments in SME debt are profitable, relatively safe, and yet not easy to get engaged into. Debitum Network will directly face and solve this problem.

GLOBAL SME FINANCING SOLUTION

Debitum is an innovative financing solution for small and medium-sized enterprises whose whole ecosystem is decentralized. The main aim of the Debitum network is to fill that global credit gap of more than $1.5trillion which do not let this small-scale industry to grow. This network is a complete end-to-end financial loop for SMEs with principal and interest moved using fiat. Debitum is built on its three strong pillars which will make it future revolutionary financing market. The three pillars are decentralization, hybrid connecting fiat and cryptocurrency and trustworthy. Whenever there is money involved in the business we choose the option which provides us with complete assurity and trust. Debitum is built on ether blockchain network which records all the transactions and makes it secure.The platform is most easy, accessible and secure way of finding financers for our small-scale industries. The Debitum network has completely revolutionized the way in which the financers and borrowers communicate and transfer value to each other.

- Rating smart contracts

- Ethereum based smart contract

- Decentralization using blockchain

- Risk assessment

- Debt collection

- Hybrid connecting crypto and fiat

- Feedback management

- Community trust rating

- Asset management

- User management

- Blockchain-based platform

DEBITUM TOKEN (DEB)

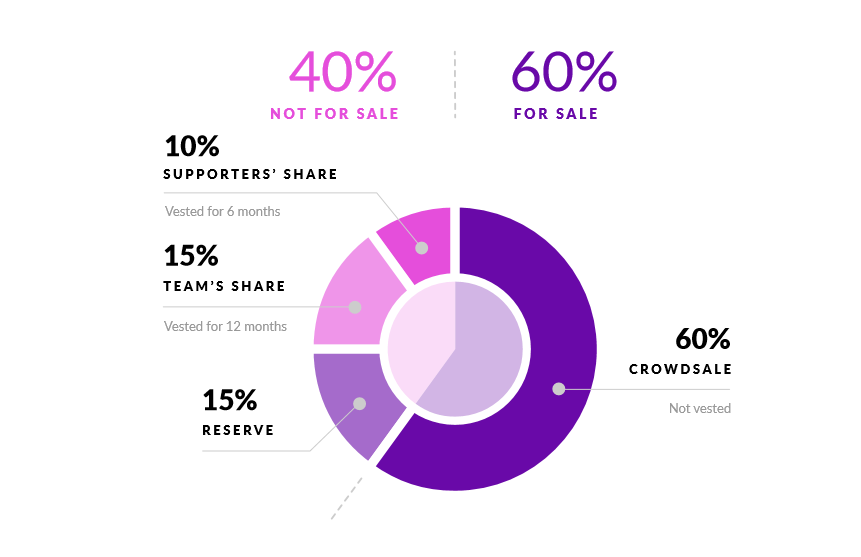

The whole ecosystem of the platform is based on this Debitum tokens which will soon be most trusted, decentralized and the global business financing ecosystem. Debitum tokens are used to access the services on this platform and also help to access premium features. The usage of tokens will be based on the number of tokens received.

These tokens are the only means of payments within this platform. One billion tokens were released during its ICO sale which was from 30th November 2017 until 30th December 2017.

CONCLUSION

Debitum network is built to leverage blockchain technology and it is the global financing solution based on ethereum network. This platform allows to lend money without any fees associated and makes it easy for the SMEs to find financers for their business globally. The Debitum network aims to take over the power from the centralized network and make it decentralized. Now you can easily connect across borders for financing with low costs. The Debitum network using ethereum smart contract will facilitate transaction and agreements. The platform connects borrowers, lenders, insurers and document validators under one flag. The Debitum network is built for borderless small business financing. The whole ecosystem is based on its tokens which will be available during for sale and these tokens are really useful to interact with the platform. The Debitum network is well-constructed financer platform which is backed by large and established IT firms. The Debitum network ensures its users with trust and secure payments globally. The project is all set to be future financing solution for SMEs.

DEBITUM TEAM

There is the great experienced team behind this successful idea which cannot be ignored. The co-founders of the project are Martins Liberts, Donatas Juodelis, and Justas Saltinis. The Mazvydas Mackevicius is the blockchain technology expert and Mart Lume is the lead product manager. The Debitum team is building international and finance operations using its professional team and advisors which will develop the Debitum network. Behind this professionals, there is the experienced team who made this project possible.

ROAD MAP

For more Informations:

Author: bakso.super

ETH: 0x0A39Baaa338F9F1f5f5b4e52f82095d0dD7c94D8

Kommentare

Kommentar veröffentlichen