Minerva is a platform built on the Ethereum blockchain and its cryptocurrency is the OWL ERC20 token. The aim of Minerva is to address mainstream cryptocurrency adoption issues and provide partnered businesses with incentivized payment solutions.

The core differences between Minerva and Bitcoin is that Minerva is designed to reward platforms that accept its OWL token with reverse transaction fees, as well as address the challenges of mainstream cryptocurrency adoption. Minerva is a platform and the OWL token is its currency. In addition to being a cryptocurrency, we are the world's first reverse merchant processor.

Minerva Technologies Limited is a blockchain technology company comprised of team members and advisors from around the world.

As displayed in the pie chart above, the token crowdsale is divided between multiple areas. 60% of the tokens will be distributed amongst crowdsale participants. 10% will be distributed amongst the management, 10% to the founding team, 7% to strategic advisors. 5% will be reserved for long-term operational costs and new advancements. 5% will be reserved to be distributed to new partnerships in the form of signing bonuses. 2% will be reserved for our bug bounty and 1% for our promotional bounty. All value transferred in exchange for OWL tokens during the crowdsale is the revenue of Minerva Technologies Limited

Minerva is the Roman goddess of wisdom and strategic warfare, trade and strategy.

We tax a % of paid out reverse transaction fees.

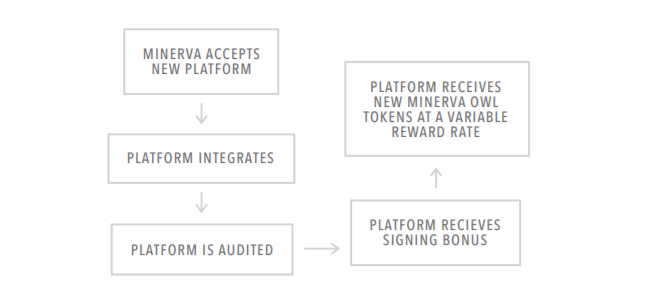

Minerva will be used on carefully selected platforms which are subjected to rigorous auditing and transparency agreements. It is unlikely we will consider partnering with any platform with a < 20,000 Alexa ranking.

MINERVA ADVANTAGE

New cryptocurrencies are introduced almost daily and their values can grow exponentially from inception. At the same time, many are abandoned after their novelty and market “honeymoon period,” thereafter quickly falling out of meaningful use. Despite these nascent cryptocurrency market features, it is clear that several statistical properties of the cryptocurrency market have been stable for years. The number of active cryptocurrencies, the market share distribution, and the turnover of cryptocurrencies remain fairly predictable.

Adopting a mathematical perspective, we see a neutral model of the cryptocurrency economy. This enables one to glean insights based on clear empirical observations, despite the varying advantages and disadvantages of one cryptocurrency over another. We have used this research to uncover the unique properties and the important factors to understanding how cryptocurrencies provide value to both end-users and long-term token holders.

What if Ripple provided a unique advantage to companies in industries beyond banking and other financial institutions?

What if Bitcoin was not controlled almost exclusively by speculation? What if Ethereum’s mining rewards went to companies that accepted it as payment and were accrued by the platforms

SPECIFICATIONS

TECHNOLOGY

Minerva is presently an ERC20 token and smart contract system built on the Ethereum blockchain. Following this standard, Minerva tokens are easily transferable between users and platforms using ERC20-compatible wallets, and can be smoothly integrated into exchanges.

SERVICE AND APPLICATION LAYER

Certain OWL tokens will be held and issued to businesses to serve as “signing bonuses” subjected to a slow-time-release algorithm and distributed on a first-come, first-served basis at 5% of the bonus vault until a point where the vault becomes nearly exhausted and a 5% signing bonus is fiscally inconsequential.

DISTRIBUTION & SUPPLY MODEL

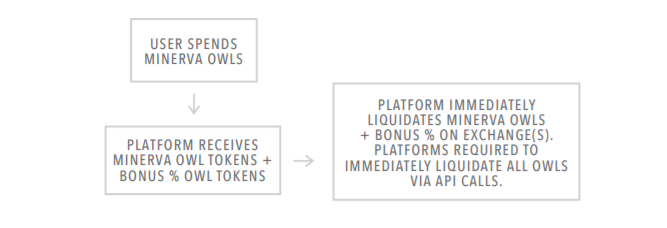

Minerva uses two advanced methods to increase and decrease the OWL token supply. The first method mints new Minerva OWL tokens and inserts them into the economy when a partner platform accepts the token as the payment method. The rate at which OWL tokens are currently entering the economy is called the “reward rate.” The reward rate is directly proportional to the price of OWL: as the price rises, the reward rate rises. The reward rate will rise until it increases the total supply enough to prevent violent short-term price swings. When the reward rate is greater than zero (0), a small portion of the rewards are sent to a contract where they can be exchanged for MVP tokens (Minerva Volatility Protocol tokens) and voting tokens. The inherently inflationary reward rate used to reward platforms is hard capped at 10%. This hard cap means supply will not dramatically change during episodes of significant growth, enabling the market price to naturally stabilize when artificial steadying is inadequate.

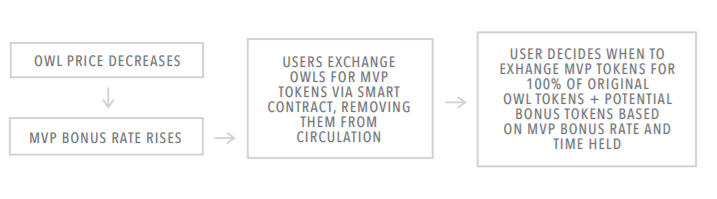

The second method sterilizes Minerva OWL tokens when their price is decreasing. Instead of a negative reward rate, we enact a system that incentivizes users to temporarily take their OWL tokens out of the economy. Users will exchange OWL tokens for MVP tokens representing a certain amount of OWL tokens which may (or may not) appreciate over a set period of time. In any instance of a price decrease MVP tokens will be sold, but the more drastic the price decrease at the time of purchase, the higher the potential appreciation value of these tokens. These MVP tokens will be able to be exchanged at a later date for the original OWL tokens paid in addition to a certain percent extra. In the event of a prolonged decline in which MVP vault funds are exhausted, the OWL token will have to naturally regain price stability.

THE VOTING SYSTEM

Minerva employs four key methods to deter voter manipulation :

- A deposit is required to vote; the deposit corresponds to the influence the participant’s vote has on Minerva’s “contract price” and the deposit decides the reward received for voting. This deposit will be lost if the vote is found to be illegitimate.

- A “votechain” is employed in this process. The votechain permits further judgment of the validity of past votes as new votes are input. When a participant votes on the current price, they are also asked to input the price from selected past moments. These votes are then compared against the previously cast votes and votes found to be illegitimate will lose their deposit. “Illegitimate votes” are defined as not falling between the 25th and 75th percentile given a sufficient sample size.

- If the amount of votes is sufficient, all cast votes are rewarded, while at the same time only a certain percent are permitted to influence the contract price of Minerva.

- Open-source exchange polling and voting automation with real-time log output as a failsafe mechanism. This safeguard is only activated if presented with evidence of a sophisticated attack occurring on the Minerva Volatility Protocol.

In addition to these aforementioned voter manipulation checks, Minerva employs the following methods to

avoid manipulation of MVP (Minerva Volatility Protocol) token prices :

- The time at which the new contract price comes into effect is randomized so as to avoid a level of predictability that would allow manipulators to know the optimal times to buy MVP tokens.

- A small fee is enacted when distributing MVP tokens or a required holding time is set to discourage market activity that resembles speculative trading.

- An “MVP Door” is enacted in which the price must decrease for a certain period of time before the ability to buy MVP tokens is available.

IMMEDIATE USE CASE

The first business to integrate into the Minerva economy is a live-streaming service with $20MM in revenue and over 10 million users. We will show a clean and concise before-and-after revenue impact of integrating with Minerva. At this time, Minerva has been advised to temporarily withhold the name of our first partnered business. We aim to integrate across a wide spectrum of large niche and mainstream businesses spanning several industries by recruiting platforms into the Minerva Smart Money Alliance (MSMA).

PRE-SALE/CROWDSALE

BASIC INFORMATION

Early adopter participation takes place through a crowdsale dashboard accessible via Minerva.com. 75,000,000 of 100,000,000 total initial Minerva OWL tokens will be distributed in two crowdsales. A pre-sale is followed by a primary Minerva crowdsale, and each are accessible to parties outside of the United States.

The crowdsales will be held in an auction format in that all distributed Minerva will be priced by the amount of contributions received, and then distributed accordingly. 25,000,000 Minerva will be excluded from the crowdsales which is described below in the “Reserve Minerva” section. After the initial 100,000,000 OWL tokens are created, new token creation, apart from bonuses associated with platform utility, will be halted permanently. Within 1 year (365 days) of the crowdsale, an announcement will be made regarding any potential 1:1 token exchanges relating to any proposed private blockchain migration.

PRE-SALE

We will be holding a token pre-sale and it is likely to be privately held.

PRIMARY FINAL CROWDSALE

After the token pre-sale, the primary and final crowdsale will take place

RESERVE MINERVA

At the end of the crowdsales the founding team will receive a 10% allocation of OWL tokens, subject to a twelve-month (12-month) holding period. These tokens will serve as a long-term performance incentive for the founding team. An additional 10% will be allocated for long-term operating costs, 2.5% will be allocated for partnerships and another 2.5% for the bug bounty program. All Minerva OWL token transfers will be restricted for two (2) months after the crowdsale ends.

ROAD MAP

FUNDED INTERNALLY

- Base Platform Development

- Internal Market Simulations

- Integration Testing / Compliance

- Content Translation

- Exchange Listings

- Legal Counsel

- Initial Security Auditing

For more Informations:

Author: bakso.super

ETH: 0x0A39Baaa338F9F1f5f5b4e52f82095d0dD7c94D8

Kommentare

Kommentar veröffentlichen